Morning Star Candlestick Chart Pattern 6 Strategies

634 likes, 5 comments - trading.tapri on January 9, 2024: "The morning star candlestick pattern . . @trading.tapri . . . . . #stocks #stockmarke."

Understanding The Morning Star Candlestick Pattern InvestoPower

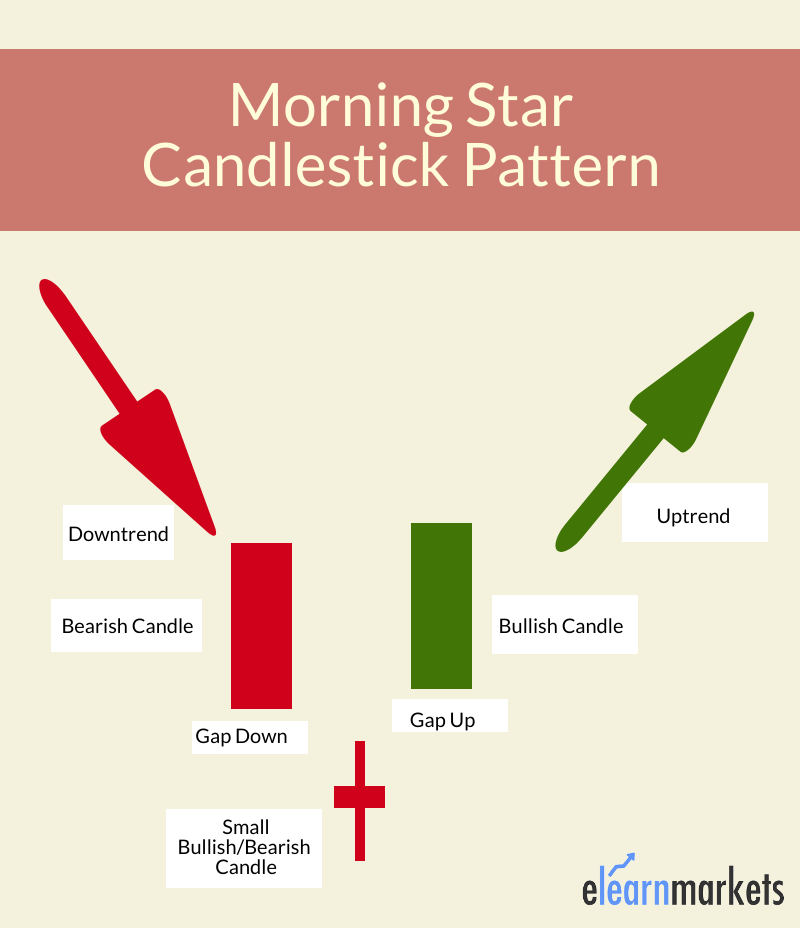

A morning star is a three candle reversal candlestick pattern that forms after a downtrend. The first candle is bearish and followed by a doji that gaps down. The third candle gaps up and finishes as a big, positive candle. In this article, we're going to have a closer look at the morning star candlestick pattern.

Morning Star Candlestick Pattern definition and guide

Morning Star Candlestick Pattern This page provides a list of stocks where a specific Candlestick pattern has been detected. If you are viewing Flipcharts of any of the Candlestick patterns page, we recommend you use the Close-to-Close or Hollow Candlesticks as the bar type, and always use a Daily chart aggregation.

Morning Star candlestick pattern How to identify and trade it in IQ

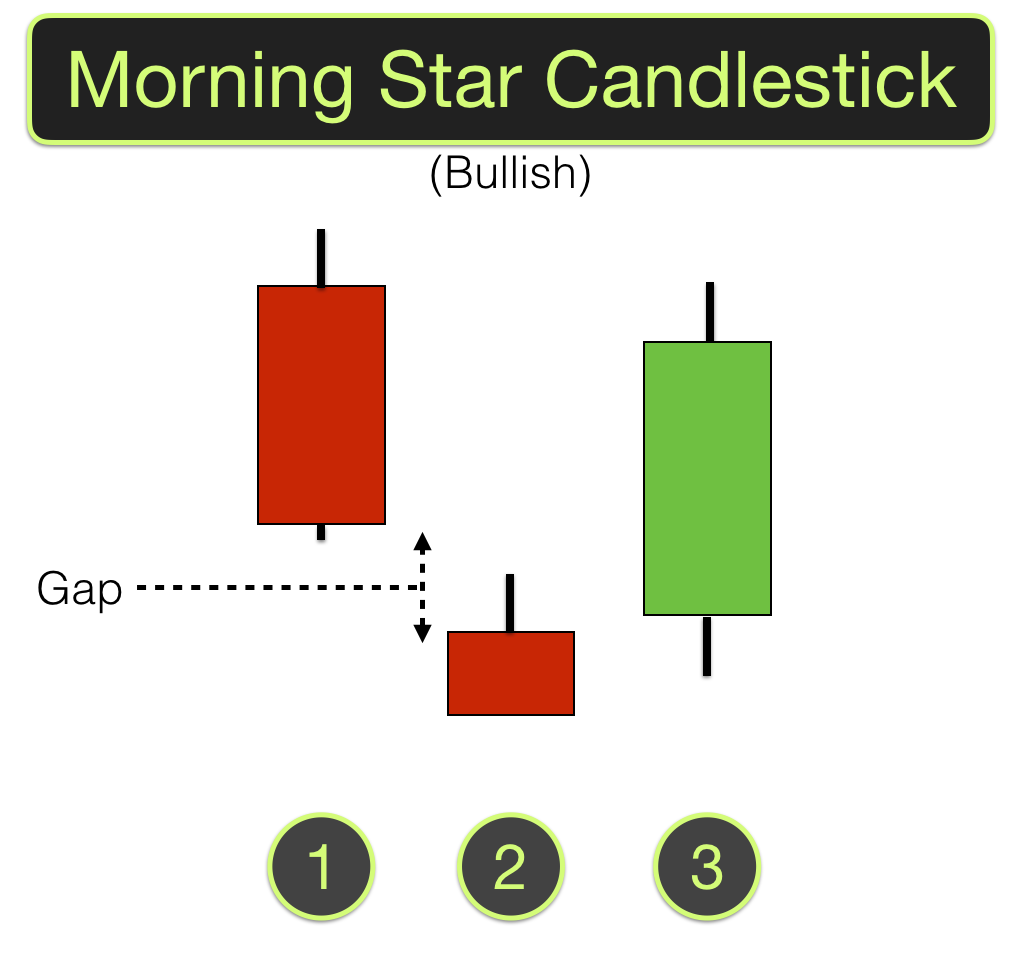

The morning star consists of three candlesticks with the middle candlestick forming a star. Morning star is a powerful candlestick pattern, and most price action traders use it in their trading strategies. However, in forex trading, no pattern can guarantee you a 100% win rate.

What Is Morning Star Candlestick? Formation & Uses ELM

The Morning Star is a candlestick pattern that is comprised of three candles. A completed Morning Star formation indicates a new bullish sentiment in the market. It is considered a reversal pattern that calls for a price increase following a sustained downward trend. The Morning Star candlestick structure starts off with a relatively long red.

Morning Star Candlestick Pattern Trendy Stock Charts

A Morning Star candlestick pattern is a reversal pattern that forms after a downtrend. The pattern has three candles: the first candle is a long red (or bearish) candle, followed by a small real-body white (or bullish) candle that gaps above the previous day's close.

Morning Star Candlestick Pattern

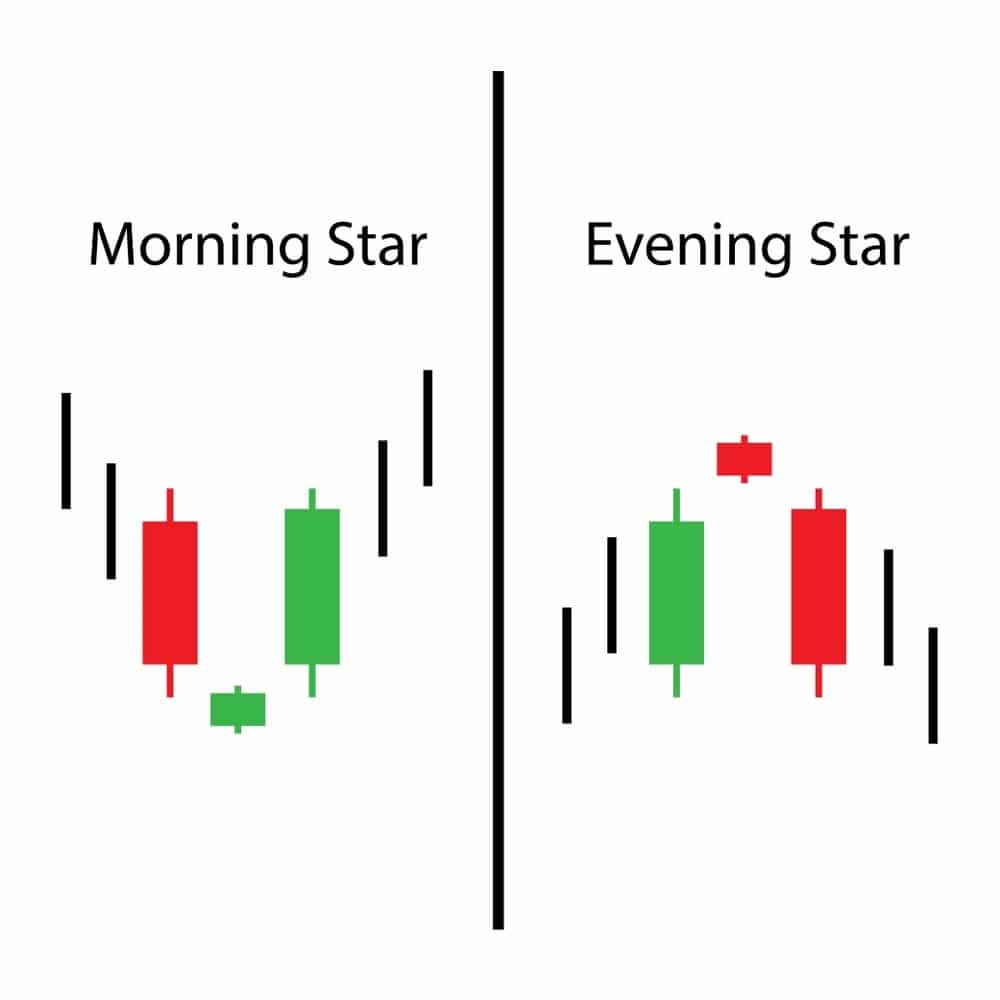

A morning star is a visual pattern consisting of three candlesticks that are interpreted as a bullish sign by technical analysts. A morning star forms following a downward trend and it.

Trading The Morning Star Candlestick Pattern Like A Pro! Forex Academy

Pasticceria da Paolo. Unclaimed. Review. Save. Share. 24 reviews #2 of 3 Desserts in Tarvisio $ Bakeries. Via delle Segherie 4, 33018 Tarvisio Italy +39 348 702 3221 + Add website + Add hours Improve this listing. See all (5) Enhance this page - Upload photos!

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish

Morning Star candlestick is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. This is one of the popular candlestick patterns used by many technical analysts. Morning Star pattern consists of three candlesticks: a big red candle, a small doji candle, and a big green candle.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

A morning star is a three-candle pattern in which the second candle contains the low point. The low point, however, is not visible until the third candle has closed. What is the Morning Star candlestick Pattern?

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern | How to Identify Perfect Morning Star Pattern - YouTube © 2023 Google LLC The Morning Star Candlestick Pattern is a bullish reversal candlestick pattern,.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Consisting of three candlesticks, Morning Star candlestick patterns generate bullish trading signals that can be used when establishing long positions in financial markets. They are used by technical chart analysts as a signal to identify bullish reversals after a downward-trending price period.

Best candlestick patterns morning star candlestick pattern

What Is The Morning Star Candlestick? The Morning Star Pattern is viewed as a bullish reversal pattern, usually occurring at the bottom of a downtrend. The pattern consists of three candlesticks: Large Bearish Candle (Day 1) Small Bullish or Bearish Candle (Day 2) Large Bullish Candle (Day 3)

Morning Star Candle Stick Pattern

What is a Morning Star Candlestick? The Morning Star pattern is a three-candle, bullish reversal candlestick pattern that appears at the bottom of a downtrend. It reveals a slowing down of.

Morning Star & Evening Star Candlesticks

The morning star candlestick appears circled in red on the daily scale. This one is in a downward price trend when the stock creates a tall black candle. The next day, a small bodied candle (the "star") gaps below the prior body. The following day a tall white candle signals the reversal of the downtrend when its body gaps above the star's body.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

The Morning Star [1] is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Description [ edit]