La Curva de Coppock Como se Calcula e Interpreta

La Curva de Coppock es un indicador del impulso de los precios para determinar los principales mínimos en el mercado de valores y se calcula como una media móvil. Se dice que la Curva de Coppock se desarrolló para estrategias a largo plazo con índices, ETF y otros instrumentos líquidos, más que para el trading intradía.

¿Qué es la Curva de Coppock y cómo se interpreta? Rankia

Using The Coppock Curve Indicator For Trading Should Not Include Trading Zero Crosses For Trades.Learn Different Approaches That Can Actually Work!.

Curva de Coppock Traders Studio

The Coppock Curve indicator is an oscillator based on momentum that identifies long-term trading opportunities in the market. It typically combines the rate of change on two different periods and evaluates the weighted moving average of the combination. KEY POINTS

La Curva de Coppock Como se Calcula e Interpreta

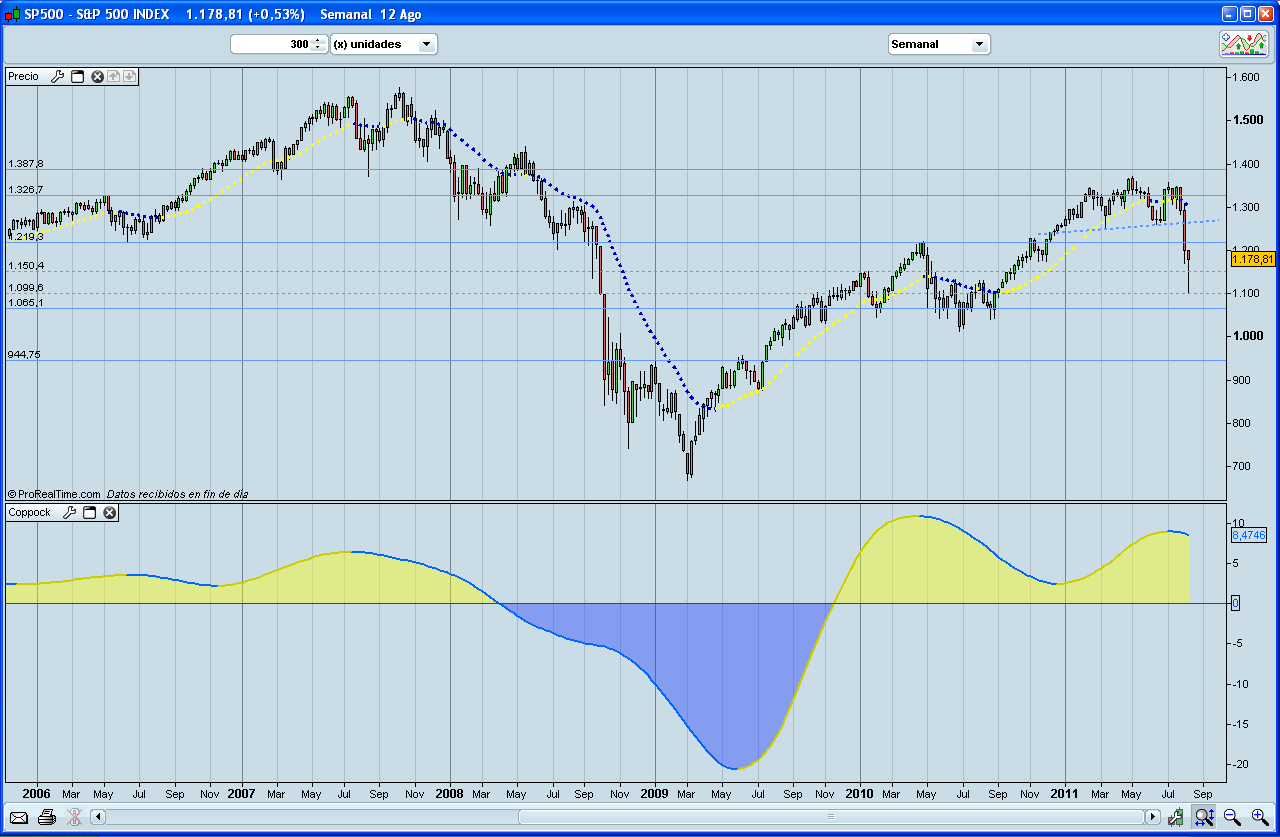

La curva Coppock, diseñada para identificar fondos en los mercados bursátiles, ha ganado reconocimiento y utilidad en diversos ámbitos del análisis técnico. Su naturaleza oscilante proporciona a los inversores valiosa información sobre posibles cambios de tendencia y puntos de entrada al mercado.

Coppock Curve Tutorial with Examples

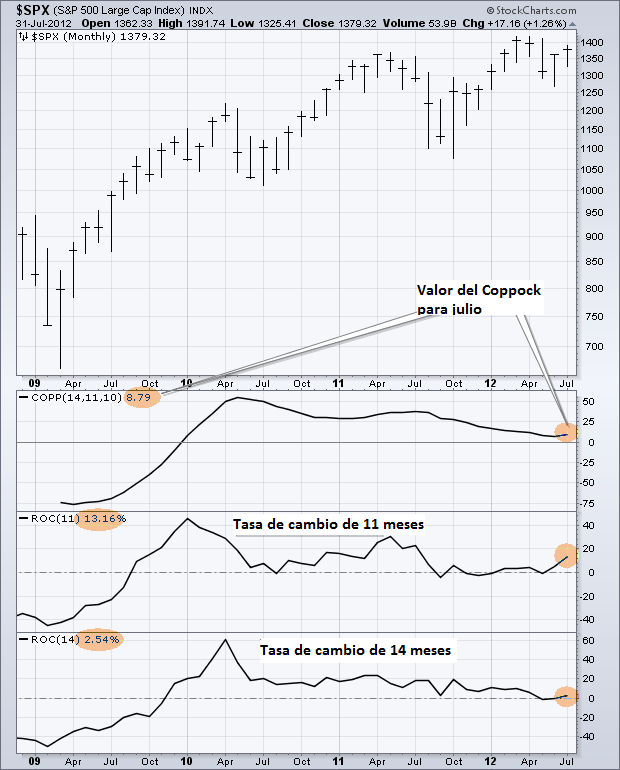

Coppock Curve = 10-period WMA of (14-period RoC + 11-period RoC) WMA = Weighted Moving Average RoC = Rate-of-Change. The Rate-of-Change indicator is a momentum oscillator that oscillates above and below the zero line. Coppock used 11 and 14 periods because, according to an Episcopal priest, this was the average mourning period when grieving the loss of a loved one.

La Curva de Coppock Como se Calcula e Interpreta

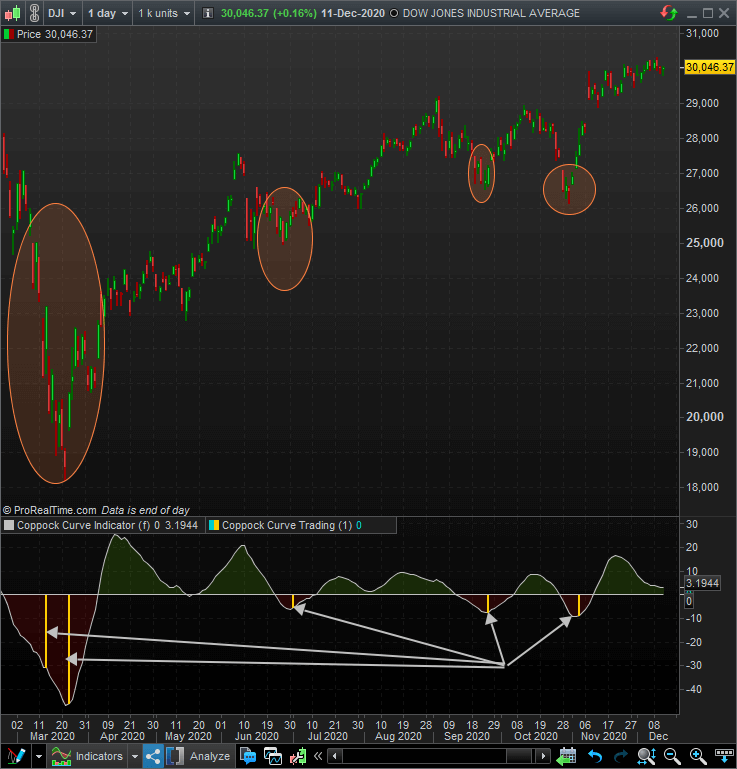

The Coppock Curve was developed by Edwin Sedge Coppock in 1965 to identify long-term buying opportunities in the S&P 500 and Dow Industrials. A buy signal is generated when the indicator crosses zero and enters into positive territory, while a sell signal is generated when the Coppock Curve falls below zero and enters into negative territory..

Coppock Curve YouTube

Curva de Coppock = WMA de 10 periodos del ROC de 14 periodos + ROC de 11 periodos Donde: -WMA: Media móvil ponderada -ROC: Tasa de cambio (del inglés Rate of Change) El indicador de tasa de cambio (ROC) es un oscilador de impulso del precio que oscila por encima y por debajo de la línea cero.

CURVA DE COPPOCK, ESTRATÉGIA DAY TRADE MINI ÍNDICE E MINI DÓLAR INVESTIR NA BOLSA DE VALORES

¿Qué es la curva de Coppock? ¿Cómo lo programo en ProRealTime? ¿Qué aspecto tiene la curva de Coppock? La idea principal es programar el indicador de Coppock y tener sentimiento alcista desde que la curva, estando aún en zona negativa, empieza a subir.

Como utilizar o indicador Curva de Coppock

The Coppock Curve is a long-term price momentum indicator used primarily to recognize major downturns and upturns in a stock market index. It is calculated as a 10-month weighted moving average of the sum of the 14-month rate of change and the 11-month rate of change for the index. It is also known as the "Coppock Guide."

La curva de Coppock

Iggy_de_la_Varga. 01 Dec. 2022. Comments (3.43K) @Rgrdoc8991 I couldn't fid one.. If you are out of the market and the coppock curve reverses upwards, 9/10 times it would be a good idea to get.

Coppock Curve [ChartSchool]

233 Share 10K views 4 years ago Using Technical Indicators for Stocks and Options Trading / Investing Coppock Curve Indicator Explained Simply and Understandably // Want more help from David.

¿Qué es la curva de Coppock? Novatos Trading Club

The Coppock Curve is a technical indicator that provides long-term buy and sell signals for major stock indexes and related ETFs based on shifts in momentum. The indicator is designed for use on.

MANUAL. OPERATIVA CON CURVA COPPOCK + MM50 (TRG) FDAX TF 2 min De Inversor a Trader

The Coppock Curve strategy is a momentum indicator, a type of strategy that is a well-known and effective strategy mainly for stocks and stock indices. This is due to inflation and productivity gains that have made stocks rise about 10% annually for over a century. You can take advantage of the upward bias by using momentum.

Indicador Curva De Coppock Leyendo Reversiones De Mercado

La curva de Coppock es un indicador técnico de mercado desarrollado en la década de los sesenta por Edwin Coppock (economista de formación) y que fue publica.

La curva de Coppock bolsacanaria.info

La curva de Coppock se puede calcular de la siguiente manera: Curp Coppock = WMA 10 de (ROC 14 + ROC 11 ) Dónde: WMA10 = media móvil ponderada de 10 períodos ROC14 = tasa de cambio de 14 períodos ROC11 = Tasa de cambio 11 períodos Al dar esta fórmula, siga los siguientes pasos:

¿Qué es la curva de Coppock? Novatos Trading Club

The Coppock Curve is a long-term price momentum indicator used primarily to recognize major downturns and upturns in a stock market index. It is calculated as a 10-month weighted moving average of the sum of the 14-month rate of change and the 11-month rate of change for the index. It is also known as the "Coppock Guide."